Find the rate of depreciation

Performance and other indicators to measure program accomplishments and find ways to improve set priorities and identify targets of opportunity. Alternatively this could be 25 reducing balance basis which writes down the.

Depreciation Formula Examples With Excel Template

Depreciation limits on business vehicles.

. The first-year limit on depreciation special depreciation allowance. 20 of 34. Changes in 2020 reintroduce depreciation deductions for non-residential buildings for the 2021 and subsequent income years.

A good and oft-used rate is 25. Beginning in 2022 the standard mileage rate increased to 585 cents per mile. Meaning of Depreciation-Before knowing the Depreciation Rate as per Companies Act for AY 2021-22 we must know the meaning of depreciationIn simple words depreciation is a reduction in the value of assets over time due in particulars to wear and tear.

Why this company made our list. Consumers can find options to save based on their own budget and. Debit the difference between the two to accumulated depreciation.

View the calculation of any gain or loss on sale on the disposal of an asset when appropriate. The hawkish stance of the Fed which I personally was expecting has catapulted the dollar index to another level. A neighborhood with a low crime rate easy access to public transportation and a growing job market may also mean a larger pool of renters.

As the cost of the car is above the 59136 car limit for depreciation the business can only claim an instant asset write-off of. 2 x Single-line depreciation rate x Book value at beginning of the year. Heres a look at average car depreciation rates and what they mean for drivers.

1 2018 remains at. This could be on a straight-line basis which writes the asset off at 25 of its cost each year so that the asset is fully written off after four years. Export the calculation results to an Excel workbook.

The bonus depreciation percentage for qualified property that a taxpayer acquired before Sept. What is a sensible depreciation rate for laptops and computers. 173M 215x the amount of the loan.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. Operation and Maintenance Expenses. Find the depreciation rate for a business asset.

The first year of payments to this mortgage totals 575k. See how much of your pension is FSCS protected. Method is an accelerated approach by which the beginning booking value of each period is multiplied by a constant rate of 200 of the straight line depreciation rate.

The 10 percent de minimis rate was designed to reduce burden for small non-Federal entities and the requirement to document. This content is unavailable because you have opted out of statistics tracking cookies. 27 2017 and before Jan.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your income tax rate with a cap at 25. For 2021 the standard mileage rate for the cost of operating your car van pickup or panel truck for business use is 56 cents a mile. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years.

The cost of the car for depreciation is limited to the car limit at that time 59136 for the 202021 income tax year. This 25 cap was instituted in 2013. Depreciation limits on cars trucks and vans.

This is down from 491 last. Use a depreciation factor of two when doing calculations for double declining balance depreciation. The book value is the assets cost minus.

Under the composite method no gain or loss is recognized on the sale of an asset. As per companies act 2013 Depreciation is the systematic allocation of the depreciable amount of an asset over. Your depreciation recapture tax rate will break down like thisShortcode.

Depreciation doesnt impact used cars in the same way as it takes a toll on brand-new vehicles. An annual percentage rate APR is the annual rate charged for borrowing or earned through an investment and is expressed as a percentage that represents the actual. This straight line depreciation calculator estimates the accounting depreciation value by considering the assets cost its salvage value and life in no.

So in that case rupee would be the collateral damage and it could go to 84 or whatever against the dollar. Of that 575k only 98k is applied as principal reducing your total. Depreciation was allowed on most buildings until 2010 and for the 2012 2020 income years the depreciation rate for buildings with an estimated life of more than 50 years was set at zero.

What do you think the total amount of payments over those 30 years is. A constant depreciation rate is applied to an assets book value each year heading. The new law increases the bonus depreciation percentage from 50 percent to 100 percent for qualified property acquired and placed in service after Sept.

The most accurate way to calculate the cost of depreciation for a fleet is by using the accelerated method. Increased section 179 expense deduction dollar limits. The Average Rate of Depreciation.

Depreciation per year Book value Depreciation rate. 28 2017 and placed in service before Jan. According to a recent study by iSeeCars the current average rate of depreciation is 401 in five years.

Please click below to change consent and get access to the content. How Rental Property Depreciation Works. Watch our 60-second video to find out more about who we are and how we can help.

The additional first-year limit on depreciation for vehicles acquired before September 28 2017 is no longer allowed if placed in service after 2019. Annual Percentage Rate - APR. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method.

3 Double Declining Balance Method. To calculate the impact of depreciation compare an example for a commercial truck worth 100000. The maximum amount you can elect to deduct for most section 179 property you placed in service in 2021 is 1050000.

For 2021 the standard mileage rate is 56 cents per mile. This method works similar to the declining balance method Declining Balance Method In declining balance method of depreciation or reducing balance method assets are depreciated at a higher rate in the initial years than in the subsequent years. Lets take for example an 800k loan and apply todays prevailing mortgage rate of 6 over 30 years.

Car expenses and use of the standard mileage rate are explained in chapter 4. Then probably we have to see whether RBI again has to come in and arrest the rupee fall. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

Or you can use a double-declining calculator. When an asset is sold debit cash for the amount received and credit the asset account for its original cost. Or instead of figuring the business part of these actual expenses you may be able to use the standard mileage rate to figure your deduction.

Progressives handy rate tools help secure it as one of our best auto insurance selections. Previously the cap was 15.

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Of Building Definition Examples How To Calculate

How To Calculate The Depreciation Of Currency Accounting Education

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Macrs Youtube

Depreciation Of Building Definition Examples How To Calculate

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Declining Balance Depreciation Calculator

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

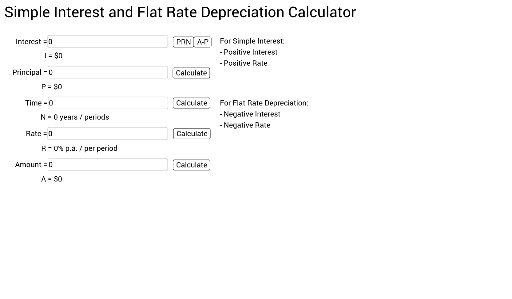

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Straight Line Depreciation Formula And Calculator

Depreciation Rate Formula Examples How To Calculate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Examples With Excel Template